capital gains tax changes uk

The rate of tax you pay at each bracket also remains the same. Capital gains tax is intended to tax the gains made when you dispose of an asset that has increased in value.

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Exclusive analysis of 540000 wealthiest individuals in the UK shows effects of low capital gains tax Why capital gains tax reform should be top of Rishi Sunaks list The maximum.

. Here is a breakdown of the income tax brackets on earnings for 2022. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. The UK government introduced non-resident capital gains tax NRCGT which applies to all non-UK residents including individuals trusts and companies.

Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts. Capital Gains Tax only applies on gains above an annual tax free allowance currently set at 12300 and 6150 for trusts. The current CGT rate for chargeable assets.

In calculating the UK capital gains tax due in respect of the gain on the sale put by them at about 39000 T deducted from the sale price amongst other things. Rumoured changes to Capital Gains Tax havent happened yet but politically it remains a soft target and we consider there to be a relatively high likelihood of reform this. Implications for business owners.

The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. Proposed changes to Capital Gains Tax. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

The changes in tax rates could be as follows. Since 6th April 2020 if. From 6 April any UK resident must tell HM Revenue and.

This doesnt apply to your main residence or your car but it applies. What are the changes. Add this to your taxable.

Find out moreNational Insurances rates. The capital gains tax CGT system could be made simpler and fairer by reducing the annual exempt amount and raising rates to match income tax according to a recent report. Many speculate that he will increase the rates of capital.

The same change will also apply for non-UK residents disposing of property. From 6 th of. The deadlines for paying capital gains tax after selling a residential property in the UK are changing from 6 April 2020.

Before you start Work out your gain to find out if you have. The Capital Gains Tax change gives property sellers more time to report the sale and pay due. 0 to 12570 Tax-free.

Any gain over that amount is taxed at what. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020. Have UK assets worth less than 150000 with the deceased having.

First deduct the Capital Gains tax-free allowance from your taxable gain. Similarly to the National. Dividend tax rates to increase.

Class 3 1585 per week. The main changes that were made to Capital Gains Tax were regarding the deadlines for paying it after selling a residential property in the UK. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

The Chancellor will announce the next Budget on 3 March 2021. The house was sold in 2016. If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners.

If you sold UK property or land before 6 April 2020 youll need to report your gains using a non-resident Capital Gains Tax return. This could result in a significant increase in CGT rates if this recommendation is implemented.

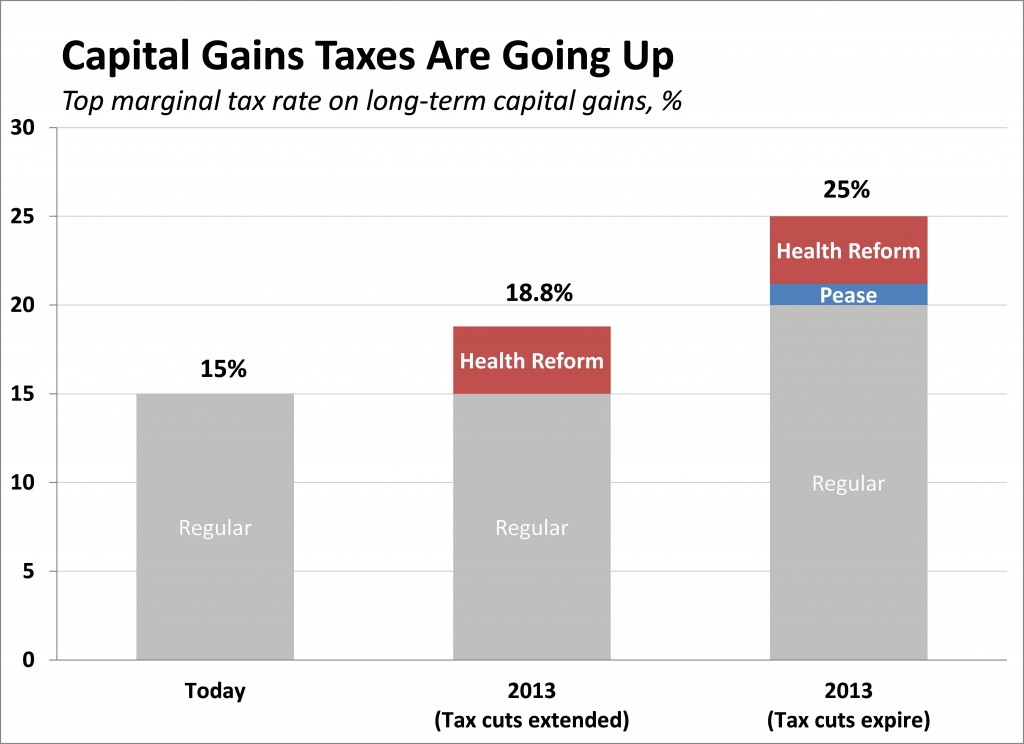

Capital Gains Taxes Are Going Up Tax Policy Center

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

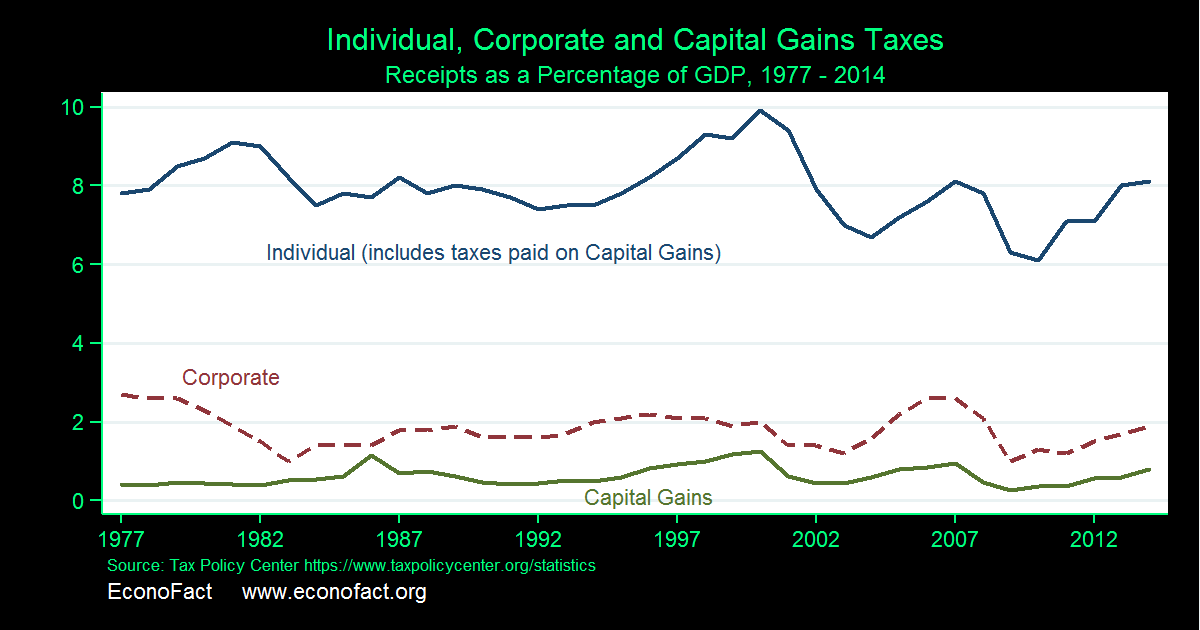

The Capital Gains Tax And Inflation Econofact

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Can Capital Gains Push Me Into A Higher Tax Bracket

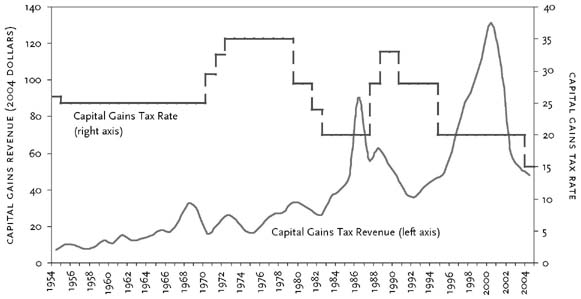

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

2022 Capital Gains Tax Rates In Europe Tax Foundation

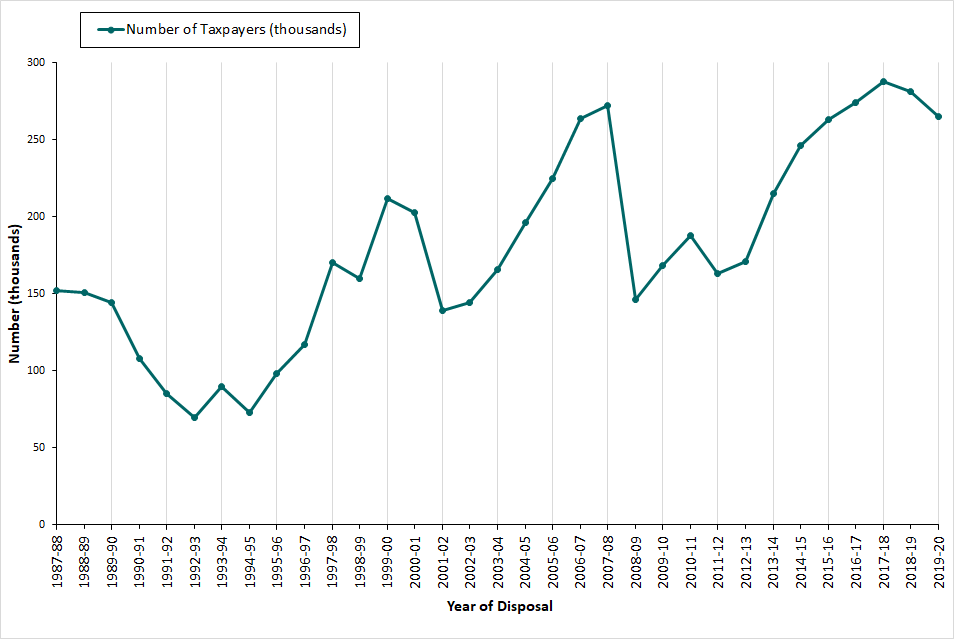

Capital Gains Tax Commentary Gov Uk

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax What Is It When Do You Pay It

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Capital Gains Affect Your Taxes H R Block

Legally Avoid Property Taxes 51 Top Tips To Save Property Taxes And Increase Your Wealth Amazon Co Uk Iain Wallis Books Property Tax Inheritance Tax Legal